- Leading into 2022, Jerome Powell determined that the Federal Reserve would stop using the term “transitory” to describe persistent inflation levels above the central bank target

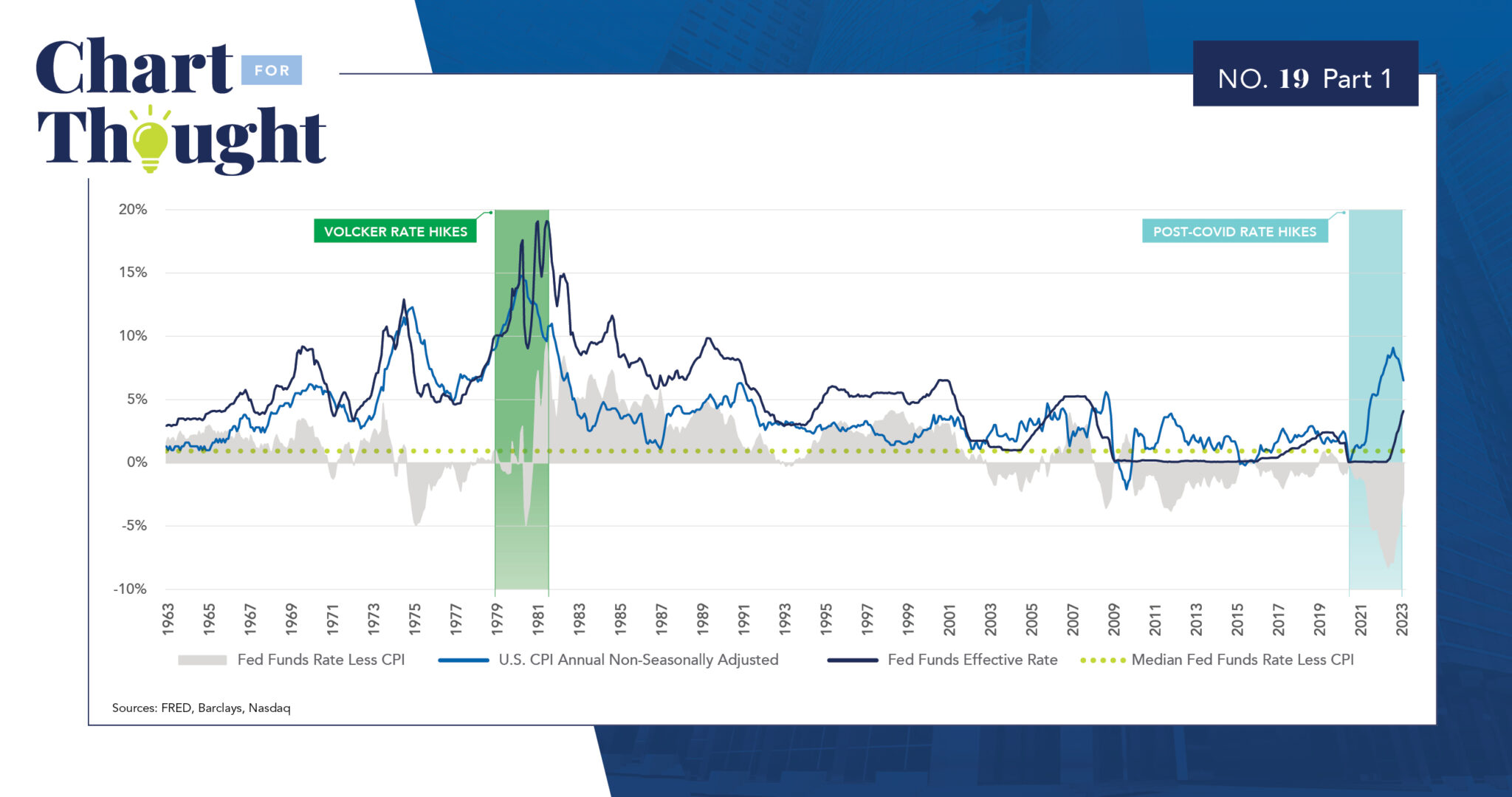

- This set off the beginning of the most aggressive rate hiking cycle in terms of speed and magnitude (450 basis points in 11 months) since the rate hikes led by Paul Volcker, Fed Chairman, in 1979

- In February, the jobs report, the CPI print, and other macroeconomic indicators such as U.S. Retail Sales surprised against expectations of moderating economic activity

- An indication that further rate hikes would likely be required to tame inflation

- Historically, as shown above, the Fed has often had to meet or exceed the rate of inflation to tame it, which the Fed has yet to do, with CPI sitting ~200 basis points above the Fed Funds Effective Rate as of the latest data

Historical Fed Funds Rate and CPI